In this post, we will talk about how government bonds can be purchased directly without any mutual fund routes. If we go through the mutual fund routes, then we need to pay an expense ratio that can range from 0.3% to 2% of the NAV value. This expense ratio is the major cost for government bond investment. Due to the expense ratio, our yield on the bond investment gets impacted and ends up providing a lower yield. So before proceeding further, we should know that government bonds are debt instrument which provides a periodical interest payment to the lender. In this post, we are only talking about tradable government bonds which are issued by the Reserve Bank of India on behalf of the government whether it be state government or central government.

We can invest in government bonds only if we have a Demat account with any depositary or a CSGL account with banks. Usually, banks do not provide support for the public who are eager to invest in government bonds. Thus, here we are only left with one option (Demat Account). Through this, we can easily invest in government bonds if we have a Demat account whether it is with NSDL or CDSL.

Demat account is used to hold the tradable government bonds in digital form just like shares or ETFs or corporate bonds. If you don't have a Demat account, you can then open your Upstox Demat account by clicking on this link. Now, those carrying a Demat account can easily invest in government bonds in the following suggested ways.

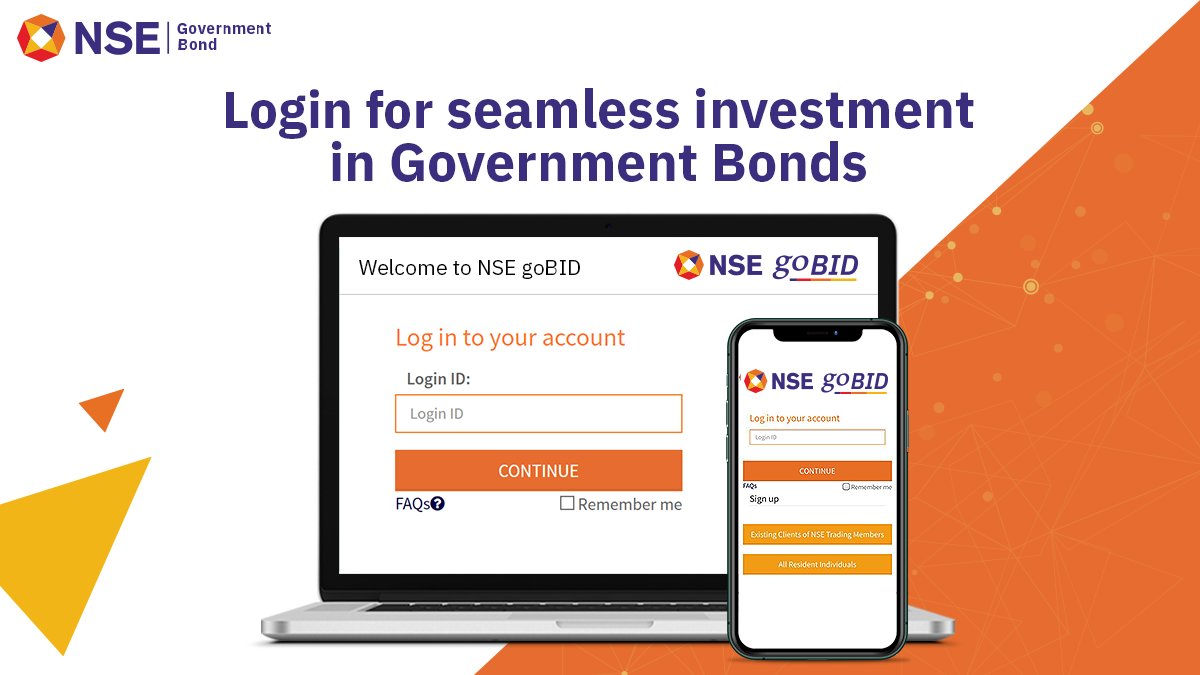

The foremost way to invest in GSEC is NSE Gobid platform

NSE GOBID is a platform of national stock exchange by which a retail investor can place a non competitive bidding with RBI before the auction date of government bonds. Here, through NSE Gobid we can easily place our order on NSE without incurring any charges. NSE works as an intermediary between RBI and a retail investor. NSE places an NCB order on E-kuber (a platform of RBI for buying bonds). After successfully placing an order, RBI issues government bonds in the SGL account of NSE India and after that NSE provides you government bonds in Demat form in your Demat account. To use this platform, all we have to do is register ourselves on the NSE Gobid app or website and after KYC validation we can easily place our orders on NSE Gobid just by paying the investment amount in the NSE India's account which is 100% safe. We have to place an order of around Rs. 10000, which is the minimum amount of Government bond investment and the upper limit is Rs. 2 Crore in a single order. https://www.nseindiaipo.com/eipodc/rest/login

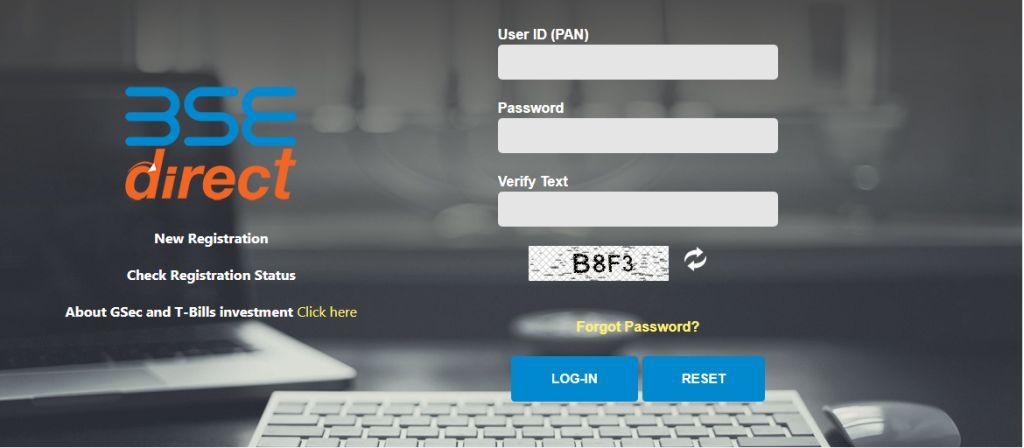

We can also invest in Government Bonds Through BSE Direct Platform

Similar to the NSE Gobid, the Bombay Stock Exchange has also initiated a way to invest in government bonds by rendering a platform, known as the BSE Direct. This platform is very much similar to the NSE Gobid platform, with its usage we can directly invest in government bonds without incurring any charges. https://www.bsedirect.com/

Buying Government Bonds Through Secondary Market Route

We can also invest in government bonds by using the secondary market, which works just like the regular stock market. We need to place our order on stock exchanges for a particular bond that we wish to buy. If we choose to invest through the secondary market, then we can also place an order of 1 unit. However, in the secondary market, liquidity is the main issue. But that is going to be resolved soon because we are working very hard to make the bond market as liquid as the equity market in India.

Investing in Government Bonds through Zerodha

We can also place our NCB order through Zerodha. All we need to do is open a Zerodha Demat and trading account by clicking on this link. After visiting this suggested website https://coin.zerodha.com/gsec, we can place our order on Zerodha and easily pay for the order by using our trading account’s funds. But before investing through Zerodha you should know that Zerodha is charging a commission of 0.06% on each order.

Through other intermediaries

We can also invest in government bonds directly through other intermediaries just by paying a commission or maintenance charges on each investment. The best example is IDBI Samriddhi. IDBI Samriddhi is a platform of IDBI bank that introduced a way to invest in government bonds. They also aim to provide liquidity in government bonds. Liquidity means they are ready to buy government bonds whenever we want to sell.

You can also learn more about government bonds by watching this playlist, which includes in-depth information on government bonds using easy-to-understand language (Hindi). This playlist contains all of my personal research on government bonds.