The issue price for sovereign gold bond scheme 2021-22 series VI is now fixed at Rs 4732 as released by the RBI on 27th August 2021 through RBI Press Release. The Sovereign Gold Bond Scheme 2021-22- Series-VI or the sixth tranche will be open for subscription from August 30 to September 3, 2021. Earlier in this financial year RBI has issued 5 traches of SGB which were priced as Rs. 4777, 4842, 4889, 4807 and 4790. Here the prices are determined by IBJA Rates each time by taking the simple average of last three business days of week preceding the subscription period. This time the nominal value of the bond is determined by taking the simple average closing price [published by the India Bullion and Jewellers Association Ltd (IBJA)] for gold of 999 purity of the last three business days of the week preceding the subscription period, i.e. August 25, August 26 and August 27, 2021 works out to ₹4,732/- (Rupees four thousand seven hundred and thirty two only) per gram of gold.

What is Gold Bond

SGBs are government securities denominated in grams of gold. They are substitutes for holding physical gold. Investors have to pay the issue price in cash and the bonds will be redeemed in cash on maturity and generally contains a coupon rate of 2.5% on the nominal amount of the sgb. The Bond is issued by Reserve Bank on behalf of Government of India. The Bond is issued by Reserve Bank on behalf of Government of India in SGL Form.

Extra Discount for investors who pay in digital mode

Government of India, in consultation with the Reserve Bank of India, has decided to offer a discount of Rs 50 per gram less than the nominal value to those investors applying online and the payment against the application is made through digital mode. "For such investors, the issue price of Gold Bond will be Rs 4682 per gram of gold," like before.

How to apply Sovereign Gold Bond

The bonds will be sold through banks (except small finance banks and payment banks), Stock Holding Corporation of Idia Limited (SHCIL), designated post offices, and recognised stock exchanges viz., National Stock Exchange of India Ltd and Bombay Stock Exchange Ltd(including NSE & BSE registered participants). you can also contact us for making application in new SGB Issue just whatsapp us.

Why Government is Issuing Sovereign Gold Bonds

The scheme was launched with an objective to reduce the demand for physical gold and shift a part of the domestic savings used for the purchase of gold into financial savings. By doing this government will save its gold import expenditure and will also raise money at lower rates compared to GSEC.

Things to consider before applying in Gold Bonds

The bonds will be denominated in multiples of gram(s) of gold with a basic unit of one gram. The tenor of the bond will be for a period of 8 years with exit option after 5th year to be exercised before the next interest payment dates also if you apply here in demat form then you can sell the bonds any time in secondary market (tax applicable in sale) to open a demat account click here. Here the minimum permissible investment is one gram of gold. The maximum limit of subscription is 4 kg for individual, 4 kg for HUF and 20 kg for trusts and similar entities per fiscal year(April-March).

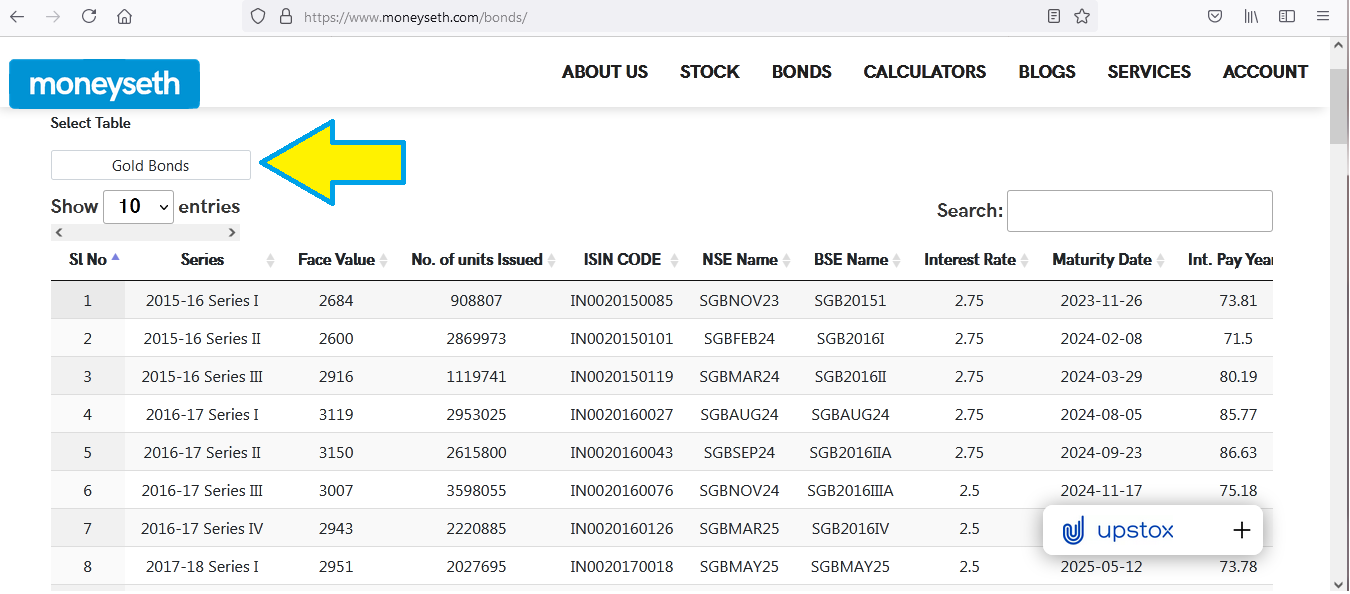

Also to know about each and every listed sovereign gold bonds then check out this link moneyseth.com/bonds.