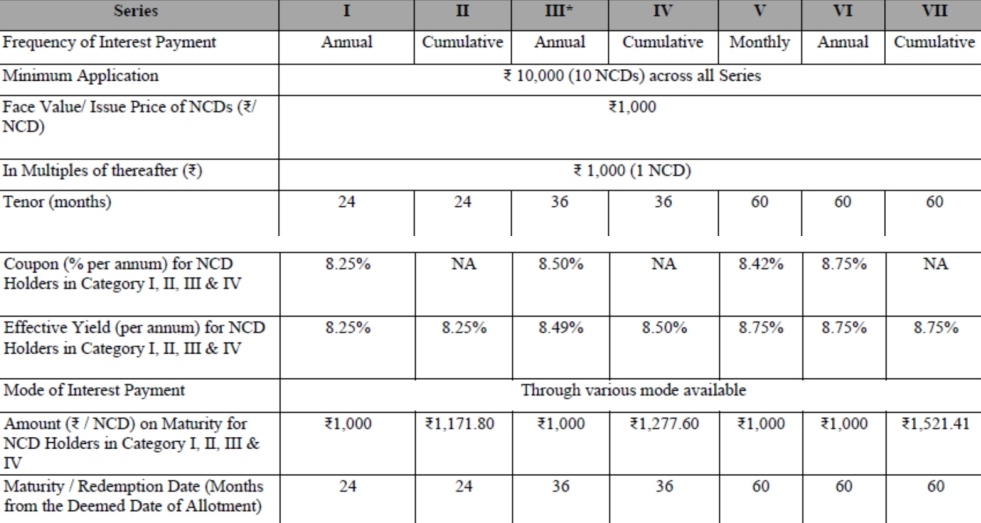

IIFL Finance Limited through its board has announced to launch public issue of secured non-convertible debentures (NCDs), which will offer coupon rates ranging from 8.25% to 8.75% per annum(For all Category of investors). The issue has a base issue size of ₹100 crore with oversubscription capacity of up to ₹900 crore, aggregating up to ₹1000 crore. The issue will be open for subscription during 27th September to 18th October, 2021.

IIFL Finance Credit Rating

It has been rated CRISIL AA/ Stable by CRISIL Limited and BWR AA+/ Negative by Brickworks Ratings India Private Limited.

History of IIFL Finance Ltd

IIFL Finance Limited (the “Company” or “Issuer”) was incorporated at Mumbai on October 18, 1995 as a private limited company with the name Probity Research & Services Private Limited under the provisions of the Companies Act, 1956. The status of the Company was changed to a public limited company and the name was changed to Probity Research & Services Limited pursuant to a fresh certificate of incorporation dated on April 28, 2000 issued by the Registrar of Companies, Maharashtra, Mumbai. The name of the Company was subsequently changed to India Infoline.Com Limited, and a fresh certificate of incorporation, consequent upon change of name was issued by the Registrar of Companies, Maharashtra, Mumbai on May 23, 2000. The name of the Company was further changed to India Infoline Limited, and a fresh certificate of incorporation, consequent upon change of name was issued by the Registrar of Companies, Maharashtra, Mumbai on March 23, 2001. Thereafter, the name of the Company was changed to IIFL Holdings Limited, and a fresh certificate of incorporation, consequent upon change of name was issued by Registrar of Companies, Maharashtra, Mumbai on February 18, 2014. Thereafter, the name of the Company was changed to IIFL Finance Limited and a fresh certificate of incorporation, consequent upon change of name was issued by Registrar of Companies, Maharashtra, Mumbai on May 24, 2019. Also, The Company has obtained a Certificate of Registration dated March 06, 2020 bearing Registration No. N-13.02386 issued by the Reserve Bank of India (“RBI”) to commence the business of a non -banking financial institution without accepting public deposits under Section 45 IA of the RBI Act, 1934.

Business of IIFL Finance

In the Fiscal 2021 company completed the sale of commercial vehicles’ financing business as a going concern, in order to focus on scaling up existing business segments of Affordable Home Loans, Gold Loans, Business Loans and Microfinance.

Current product offerings are detailed below:

Home Loans: include finance for purchase of flats, construction of houses, extension and for improvement in the flats/homes.

Business Loans: include loans against property and small and medium enterprise financing. Loan against property (LAP) is availed for working capital requirements, business use or acquisition of new commercial property. In the medium and small enterprise financing segment (MSME), we provide working capital finance to small business owners. We provide small ticket loans, thereby being able to meet the needs of small scale businesses including standalone shops etc.

Gold Loans: includes finance against security of mainly used gold ornaments. We offer loan against gold to small businessmen, vendors, traders, farmers and salaried people for their personal needs as well as for working capital needs.

Microfinance: includes credit support mainly to women, who have either limited or no access to formal banking channels. We provide financial services to the economically weaker sections of society with an aim to bring microfinance services to the doorstep of the rural and semi-urban BoP (Bottom of Pyramid) families in India. Loans are offered under various categories such as income generation, education, sanitation etc. We follow the Grameen Model (also regarded as joint liability group).

Construction and Real Estate finance: includes loans to developers for construction and development of predominantly affordable residential projects and a small proportion of mixed-use projects. In line with our broader retail strategy, the construction finance vertical is an enabler for providing retail loans under the approved project route, wherein the Company has tie-ups with developers for funding the property buyers under the retail home loan category.

Capital Market Finance: includes Loans against Securities, Margin Funding, IPO financing and other structured lending transactions.

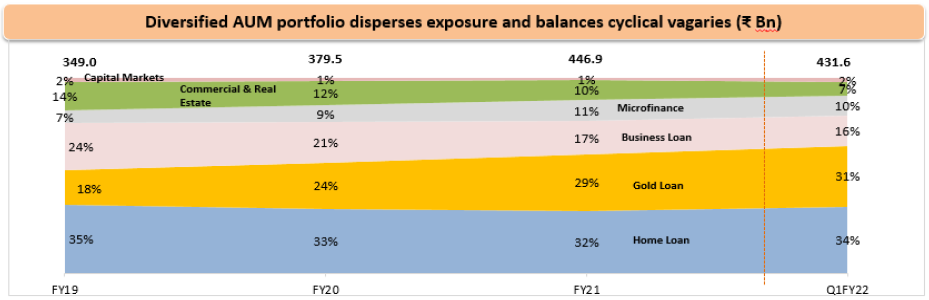

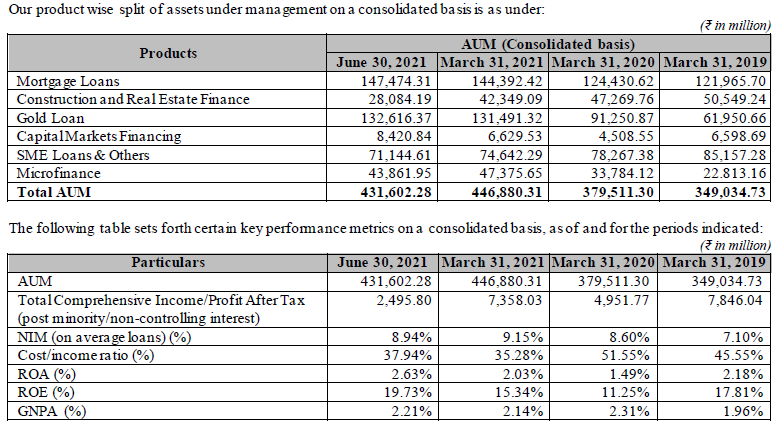

Financials of the IIFL Finance

On the financial performance front, on a consolidated basis, for the last three fiscals, IIFLFL has posted total income/net profits of Rs. 5148.96 cr. / Rs. 795.80 cr. (FY18-19), Rs. 4926.13 cr. / Rs. 503.47 cr. (FY19-20) and Rs. 5989.40 cr./ Rs. 760.81 cr. (FY20-21). Thus it has shown inconsistency in its top and bottom lines for these periods.

Objects of the Issue

The Company proposes to utilize the funds which are being raised through the Issue, after deducting the Issue related expenses to the extent payable by the Company (“Net Proceeds”), towards funding the following objects (collectively, referred to herein as the “Objects”):

1. IIFLFL will utilize 75% of net proceeds for the purpose of onward lending and for repayment of interest and principal of existing debts of the Company; and

2. Rest of 25% of net proceeds will be utilized for general corporate purposes;

Issue Size

Here the company is issuing Secured, Redeemable, Non-Convertible Debentures of face value of Rs.1,000 each, for an amount of Rs.100 Crores (“Base Issue Size”) with an option to retain oversubscription up to Rs.900 Crores aggregating up to Rs.1000 crores (“Tranche I Issue Limit”) (“Tranche I Issue”) which is within the Shelf Limit of Rs.5000 crores (“Shelf Limit”)

Issue Structure:

Addional Incentive for existing holders

All Category of Investors in the proposed Issue who are also holders of NCD(s)/Bond(s) previously issued by the Company, and/ or its group company, IIFL Home Finance Limited as the case may be, and/or are equity shareholder(s) of IIFL Finance Limited as the case may be, on the Deemed Date of Allotment and applying in Series I, Series III, Series V and/or Series VI shall be eligible for additional incentive of 0.25% p.a. provided the NCDs issued under the proposed Issue are held by the investors on the relevant Record Date applicable for payment of respective coupons, in respect of Series I, Series III, Series V and/or Series VI.

For all Category of Investors in the proposed Issue who are also holders of NCD(s)/Bond(s) previously issued by the Company, and/ or its group company, IIFL Home Finance Limited as the case may be, and/or are equity shareholder(s) of IIFL Finance Limited as the case may be, on the Deemed Date of Allotment applying in Series II, Series IV and/or VII, the maturity amount at redemption along with the additional yield would be ₹ 1,177.30 per NCD, ₹ 1,286.45 per NCD and/or ₹ 1,539.00 per NCD respectively provided the NCDs issued under the proposed Issue are held by the investors on the relevant Record Date applicable for redemption in respect of Series II, Series IV and/or Series VII.

Nature of Security provided for IIFL Finance Secured NCDs

From Series I to IV is secured in nature. Further The Secured NCDs shall be secured by way of First pari passu charge on receivables of the Company, both present and future, book debts, loans and advances and current assets of the Company, created in favour of the Debenture Trustee, as specifically set out in and fully described in the Debenture Trust Deed, except those receivables present and/or future specifically and exclusively charged in favour of certain existing charge holders, such that a security cover of 100% of the outstanding principal amounts of the Secured NCDs and interest thereon is maintained at all time until the Maturity Date.

How to apply for IIFL FINANCE NCD Issue

If you are planning to apply for this NCD issue then you can apply here through online and offline both modes. If you are planning to apply through online mode then you can apply here through your net banking option just like you apply for your Equity IPOs or you can also contact us on this number +917003419137 for online application. Now if you are planning to apply here through offline mode then you have to fill the physical application form and have to submit it to your broker.