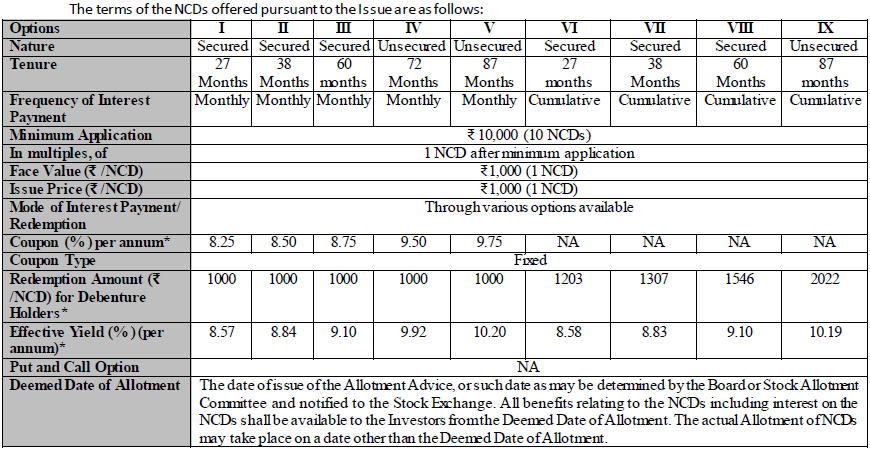

Muthoot Fincorp Limited through its board has announced to launch public issue of secured and unsecured non-convertible debentures (NCDs), which will offer coupon rates ranging from 8.25% to 9.75% per annum(For all Category of investors). The issue has a base issue size of ₹200 crore with oversubscription capacity of up to ₹800 crore, aggregating up to ₹1000 crore. The issue will be open for subscription during 30th September to 26th October, 2021.

Muthoot Fincorp Credit Rating

It has been rated "CRISIL A+/Stable” by CRISIL Limited.

History of Muthoot Fincorp Ltd

The Company was originally incorporated as a public limited company known as Muthoot Debt Management Services Limited, pursuant to receipt of a certificate of incorporation dated June 10, 1997, from the ROC. The Company received a certificate for commencement of business on June 10, 1997. Subsequently, the name of the Company was changed to Muthoot Fincorp Limited and a fresh certificate of incorporation dated March 19, 2002 was issued to the Company by the ROC. The Company was registered as a non-deposit accepting NBFC with the RBI pursuant to the certificate of registration No. 16.00170 dated July 23, 2002 issued by the RBI under Section 45 IA of the RBI Act.

Currently, Company operates 3,659 branches located across 24 states, including union territory of Andaman and Nicobar Islands and the national capital territory of Delhi and employed 16,855 employees including 233 contracted experts in its operations.

Business of Muthoot Fincorp

MFL have been engaged in the Gold loans business for over a decade and are headquartered in Kerala, India. MFL provides retail loan products, primarily comprising of Gold loans. Gold loan products include Muthoot Blue Guide Gold loan, Muthoot Blue Bright Gold loan, Muthoot Blue Power Gold loan, Muthoot Blue Bigg Gold loan, Muthoot Blue Smart Gold loan and 24x7 Express Gold loan. The product of MFL, the “24x7 Express Gold loan” can be utilised by individuals who require quick loans against their gold jewellery and who have an existing loan with the Company. This is a type of top up loan. “Smart Plus Gold loan”, the other Gold loan variant of MFL is specifically designed for salaried customers, with tenure of up to 24 months.

In addition to the Gold loan business, MFL provides foreign exchange conversion and money transfer services as sub-agents of various registered money transfer agencies. MFL is also engaged in following business:

i. generation and sale of wind energy through its wind farms located in Tamil Nadu; and

ii. real estate business through joint venture developers of the company owned land parcels;

MFL’s subsidiaries are engaged in the following businesses:

i. subsidiary Muthoot Housing Finance Company Limited providing affordable housing loans; and

ii. subsidiary Muthoot Microfin Limited, providing micro credit facility to aspiring women entrepreneurs;

MFL is also authorised to act as a depository participant of CDSL as category II.

Financials of the Muthoot Fincorp

On the financial performance front, for the last three fiscals, MFL has (on a consolidated basis) posted total revenue/net profits of Rs. 3353.76 cr. / Rs. 372.61 cr. (FY19) and Rs. 3765.99 cr. / Rs. 257.93 cr. (FY20) and Rs. 4101.19 cr. / Rs. 397.28 cr. (FY21). Despite a surge in total income, it has suffered a setback in FY20 in line with general market trends.

For the Fiscal 2021, Fiscal 2020 and Fiscal 2019 revenues from Gold loan business constituted 93.60%, 87.84% and 82.86% of total income on standalone basis as per Ind AS, respectively. For the Fiscal 2021, Fiscal 2020 and Fiscal 2019 the gold loan portfolio of the Company earned an interest of ₹2,91,839.88 lakhs, ₹2,39,327.28 lakhs and ₹2,05,896.50 lakhs on standalone basis as per Ind AS, respectively.

Our gross loans under management as of March 31, 2021, March 31, 2020 and March 31, 2019 was ₹18,68,938 lakhs, ₹14,14,013 lakhs and ₹12,08,839 lakhs respectively on a standalone basis as per Ind AS. For the period ended March 31, 2021, March 31, 2020 and March 31, 2019, the Company held 59.40 tonnes, 50.59 tonnes and 48.85 tonnes of gold jewellery respectively, as security for all Gold loans.

Objects of the Issue

The Company proposes to utilize the funds which are being raised through the Issue, after deducting the Issue related expenses to the extent payable by the Company (“Net Proceeds”), towards funding the following objects (collectively, referred to herein as the “Objects”):

1. MFL will utilize 75% of net proceeds for the purpose of onward lending and for repayment of interest and principal of existing debts of the Company; and

2. Rest of 25% of net proceeds will be utilized for general corporate purposes;

Issue Size

Here the company is issuing Secured and Unsecured, Redeemable, Non-Convertible Debentures of face value of Rs.1,000 each, for an amount of Rs.200 Crores (“Base Issue Size”) with an option to retain oversubscription up to Rs.800 Crores aggregating up to Rs.1000 crores.

Issue Structure:

Nature of Security provided for Muthoot Fincorp Secured and Unsecured NCDs

Senior (the claims of the Secured Debenture Holders holding NCDs shall be superior to the claims of any unsecured creditors, subject to applicable statutory and/or regulatory requirements). The Unsecured Redeemable NCD (subordinated to other creditors) shall be eligible for Tier II Capital, subject to applicable RBI requirements and other applicable statutory and/or regulatory provisions. The principal amount of the Secured NCDs to be issued in terms of this Prospectus together with all interest due on the Secured NCDs, as well as all costs, charges, all fees, remuneration of Debenture Trustee and expenses payable in respect thereof shall be secured by way of subservient charge with existing secured creditors on all loan receivables (both present and future) of the company in favor of Debenture Trustee, to be held on pari passu basis among the present and / or future NCD holders, as may be applicable equal to the value 1 time of the debentures outstanding plus interest accrued thereon.

How to apply for Muthoot Fincorp NCD Issue

If you are planning to apply for this NCD issue then you can apply here through online and offline both modes. If you are planning to apply through online mode then you can apply here through your net banking option just like you apply for your Equity IPOs or you can also contact us on this number +917003419137 for online application. Now if you are planning to apply here through offline mode then you have to fill the physical application form and have to submit it to your broker.