IPO full form is Initial Public Offereing. IPO is a process by which a privatly owned company issues its shares in public through stock exchanges either through OFS(Offer for Sale) or through Fresh Issue. OFS is used by existing shareholders to sale their holdings in public and Fresh Issue is used by the company to take fresh funds from public.

Why Company Issue IPO

Why Company Issue IPO

Company raises equity fund from public by issuing IPO. Generally company issues equity shares for very long term business purposes. In equity funding, company does not have any liablity to pay back the funds to equity share holders in any case other than liquidation or bankruptcy. Equity shares are refered as less risky for the business of the company because there is nothing as a fixed obligation to pay as it is available in debt funding (Bank Loan etc.) but it cost the company's existing shareholders very much because the promoters are compromising their shareholding percentange and in some cases their control over the company so if we say it is the costliest funding option then it is not wrong.

Who can apply in IPO and How to apply

Any person who has attained the age of 18 and is not restricted to act in the stock market by SEBI can apply for IPO in India if the person has the following documents and account such as a valid PAN Card, a Demat Account and a Bank Account can apply for IPO through many routes such as UPI, ASBA or by filling Physical form.

What is the benefit of applying in IPO

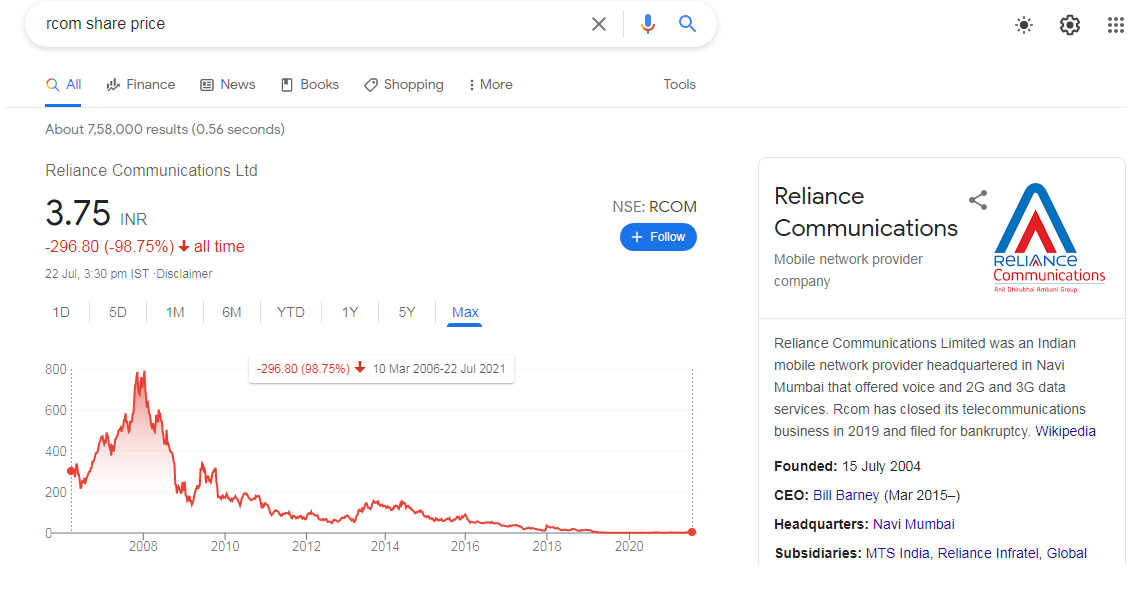

Suppose if the company in which you are applying is very good and have a siginificant market share in the industry from which it belongs can give you many benefits such as on the day of listing it can provide you short term gain by listing at a premium or can provide you long term gains and a oppertunity to grow your money many times just like Infosys Company but there is also a risk of lossing money for example many investors had lost their substantial part of their money in Coal India and RCOM.

IPO Investing Suggestion (Conclusion)

So after watching the above image I think now you can cleary understand the risk portion of IPO Investment. So it is better for you to understand the consequences which can happen in future for that particular company in which you are investing through IPO route. IPO can provide you exceptional returns and can also wipe out your substantial capital so it is always better to choose good company with good future growth rate.